You persevere because you have faith in a better future. However, meticulously tracking expenses seldom let you feel that way.

The reason why most of us don’t stick to a budget religiously is because it doesn’t feel good. Last month you overspent on entertainment but underspent on dining out, this month you overspent on clothings but underspend for entertainment. Managing finances should be a guilt-free process and make us feel empowered and in control. If you don’t feel so, that means that method does not serve you well.

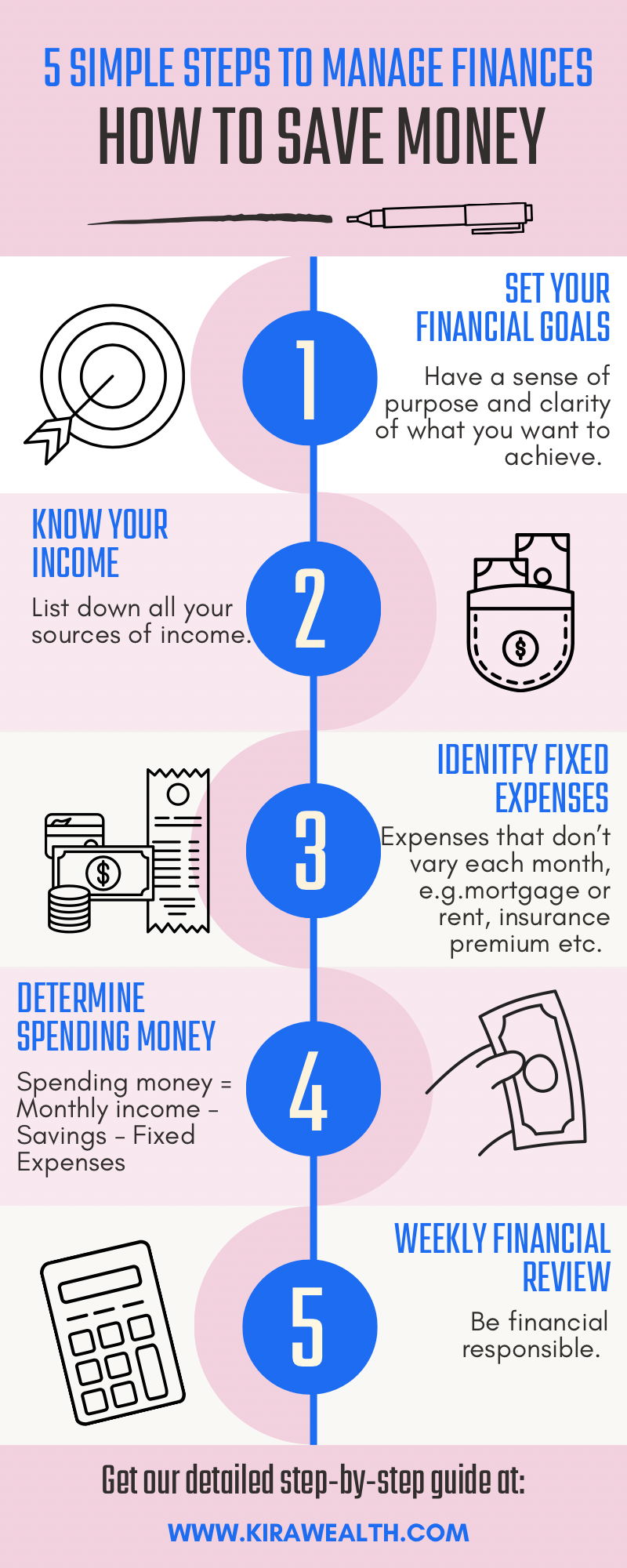

You don’t have to ditch your budget entirely. We simplify your budgeting process into 5 simple steps here which will help you to figure out how to save money.

Step 1: Set your financial goals

First of all, you have to decide what you want to achieve financially. How much you want to save each month for retirement or investment or emergency funds or down payment on your dream house? Or, perhaps paying off debts and also that long overdue family vacation? Having a financial goals is crucial as it provides you a sense of direction and sense of purpose.

What you want to save for?

How much you need?

How long you want to achieve your target?

Now you have the clarity of what you truly want to achieve and that should help you to stay focus managing your finances.

Step 2: Know your income

Next, you have to know where you stand. Factor in all sources of income that you receive in a given period, say a year. This may includes salary, bonuses, incentives, side income, dividends, interest payment, rental income and so on. When you have a comprehensive understanding of your income, you can make better financial decisions about your spending and saving habits.

Step 3: Know your expenses : Identify fixed expenses

List down all your expenses. Identify your fixed expenses. Fixed expenses includes mortgage payment or rent, insurance premium, subscriptions, car loan instalments, debt payments, and so on. The amount of fixed expenses does not varies over the month. On the other hand, variable expenses would groceries, dining out, entertainment, personal care, clothings, etc.

Step 4: Calculate monthly spending money.

Spending money = Monthly Income – savings – fixed expenses

Financial gurus Warren Buffett was famously quoted for saying, you have to pay yourself first before paying others to manage your finances well. Savings is the portion that you pay yourself. Once you put aside this amount, you can spend the rest as you like. You don’t have to feel guilty again that you might overspend just because of an extra cup of Starbucks coffee.

Step 5: Weekly financial review: Be financially responsible

Set a time during weekend to do your personal financial review. Check on the balance of free spending money each week. If you don’t have much left for the last week, then you know you have to opt for home cook meal or hawker food the coming week. Keep in mind, you don’t have to sub-categorize your expenses as you want to have more flexibility and freedom in deciding what to spend instead of being restricted by a tight budget for living your life.

This is also a great time for you to ponder about generating more money by

having a side income or ask for a raise.

It would be ideal to have different bank accounts for different purposes. With so many credit cards and e-wallet, it might be a bit complicated to keep track of your spending money balance.

Accounting apps such as Wave app and Fleur Budget could come to rescue.

What are those 50 30 20 budget or 70 20 10 rule of money? These numbers are the percentage of allocating money for “needs”, “wants” and “savings / debt payment”.

In fact, there is no one-size-fit-all financial solution. These rules sounds like brilliant ideas, theoretically. However, practically, following these rules may entail to more frustration and financial anxiety.

The bottom line is to allocate 20% or more of your income for savings.

Allow yourself to have more flexibility when managing your money flow.

With such flexibility, you will find it’s your second nature to spend within your limits and you really don’t need those rule to rule over your life.